Wyoming vs Delaware vs Nevada: Which is Best for Your Business in 2025?

Share

Starting a business in the United States? You've likely come across the three most popular states for forming an LLC: Wyoming, Delaware, and Nevada. While each offers unique benefits, the best choice for your startup depends on your goals, budget, and the nature of your startup

In this guide, we’ll compare these three startup friendly states across key factors like privacy, taxes, costs, and ease of formation to help you make the smartest decision.

✅ 1. Business Privacy & Anonymity

- Wyoming: One of the few states that allows anonymous LLCs. Your name doesn't appear in public records, which is ideal for entrepreneurs seeking privacy.

- Delaware: Offers strong corporate laws but requires listing a registered agent, and certain information may be disclosed.

- Nevada: Provides decent privacy, though not as anonymous as Wyoming.

Winner: Wyoming – If privacy is a priority, Wyoming leads the way.

💰 2. State Taxes

- Wyoming: No corporate income tax, no franchise tax, and no personal income tax.

- Delaware: No sales tax, but does have franchise taxes and fees that increase with business size.

- Nevada: No corporate or personal income tax, but higher annual fees and stricter compliance requirements.

Winner: Wyoming – Most tax-efficient for small to medium-sized businesses.

💵 3. Formation & Annual Costs

- Wyoming: Around $100 to form, $60 annually for report fees. Affordable registered agent services are widely available.

- Delaware: $90 to form but franchise taxes can climb, especially for C-Corps.

- Nevada: $425+ initial costs and higher yearly fees, including business licenses.

Winner: Wyoming – Cheapest option with straightforward filing.

🌍 4. Popular Use Cases

- Wyoming: Ideal for e-commerce businesses, remote entrepreneurs, digital nomads, and international founders.

- Delaware: Favored by venture-backed startups, tech companies, and large corporations.

- Nevada: Chosen by real estate investors and service businesses seeking favorable liability laws.

Winner: Depends on your niche. Choose Delaware for raising VC funding, but Wyoming wins for most small businesses.

📊 5. Compliance & Maintenance

- Wyoming: Simple annual report. No complex regulations for small LLCs.

- Delaware: Requires more compliance (especially for C-Corps).

- Nevada: Higher regulatory burdens and paperwork.

Winner: Wyoming – Hassle-free annual maintenance.

🧠 Conclusion: Which State Is Best for Your Startup in 2025?

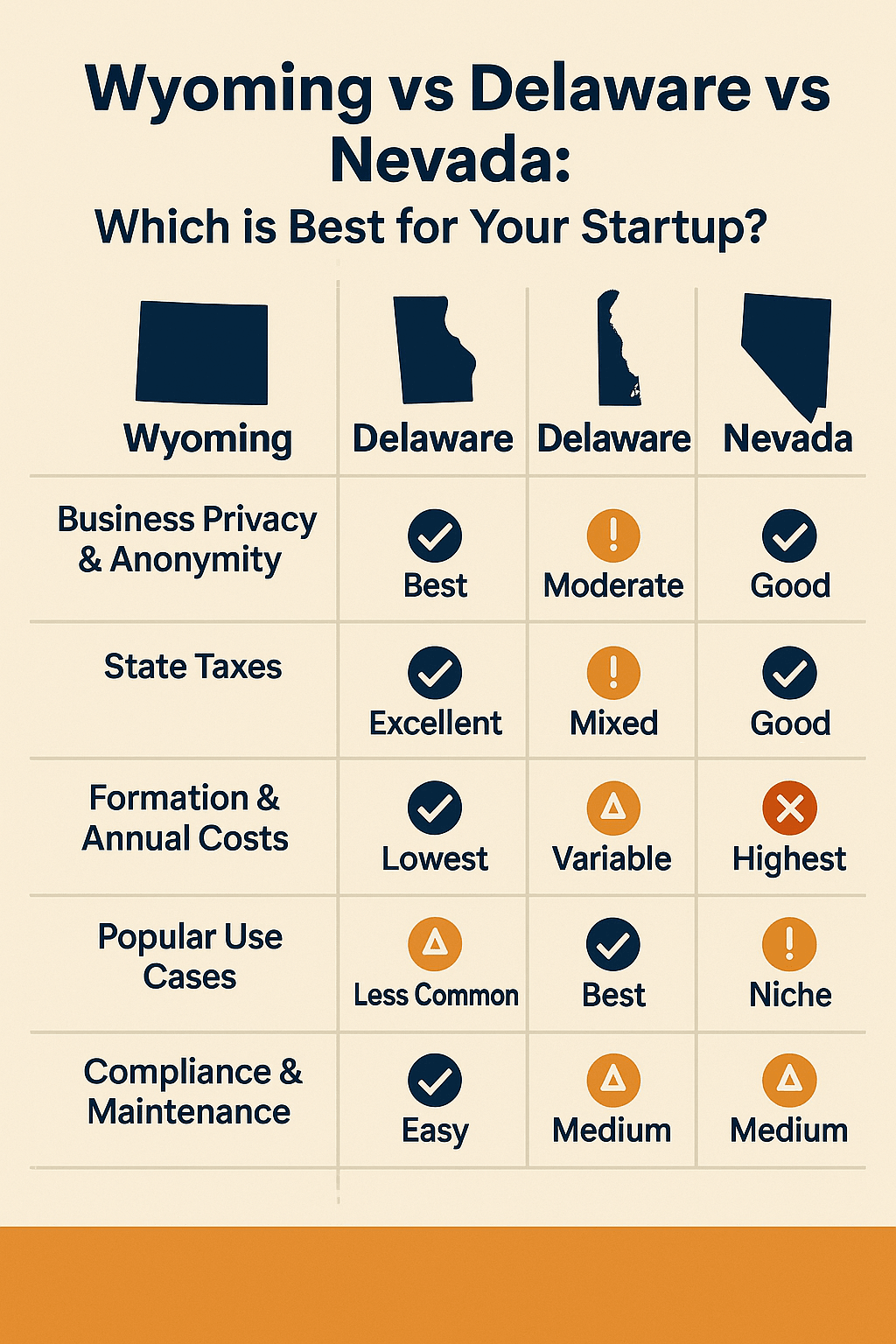

| Feature | Wyoming | Delaware | Nevada |

| Privacy | ✅ Best | ⚠️ Moderate | ✅ Good |

| Tax Benefits | ✅ Excellent | ⚠️ Mixed | ✅ Good |

| Costs | ✅ Lowest | ⚠️ Variable | ❌ Highest |

| VC Funding | ⚠️ Less Common | ✅ Best | ⚠️ Niche |

| Ease of Setup | ✅ Easy | ⚠️ Medium | ⚠️ Medium |

🏆 Recommendation: If you're starting a small business, e-commerce store, digital agency, or freelance service, Wyoming is likely the best all-around choice in 2025.

For venture-funded startups, Delaware remains the standard. Nevada may suit specific asset protection strategies, but it’s pricier.

📌 Ready to Start Your Wyoming LLC?

At Focussphere, we help international and U.S.-based founders set up Wyoming LLCs fast, affordably, and with full support.